What is Wealth?

It is important to note that wealth is subjective. One must define what wealth means. But we can all agree in the following general statement:

Wealth is the abundance of valuable resources or material possessions. Being wealthy is considered as having adequate income /savings to support your lifestyle – what ever that may be.

It is good to understand the right formula in saving money. However, saving is not enough. One must understand that in order to build wealth, a powerful concept must be applied, the wealth formula.

What is the wealth formula?

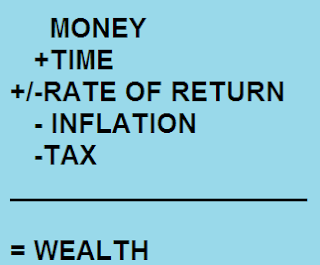

The wealth formula states: money (+) time (+/-) rate of return (-) inflation and (-) tax = wealth. Let’s define each element.

(+) Money

No one becomes wealthy without money. Therefore, money is the number 1 ingredient in building wealth. This money can come from your income, savings or other sources. However, money alone cannot make you wealthy; it requires accounting the other elements.

(+) Time

Building wealth takes time, not a get-rich-quick scheme. Buying a property now and selling it tomorrow earning 10x your capital is impossible.

(+/-) Rate of return

This shows the interest rate your money is growing. However, it is positive if the interest is in savings or investments and negative if the interest is applied on debt.

(-) Inflation

This is the rate of increase in the prices of commodities. In the US, the average inflation rate is 3.28% per year. This means that the value of commodities increases by 3.28% of their current price. This shows a negative value in your wealth as inflation reduces the buying power of your money every year, guaranteed!

(-) Tax

They say change is the only permanent thing in the world, now, so is tax. From womb to tomb, there will always be tax.

Adding all the elements: money (+) time (+/-) rate of return (-) inflation (-) tax, whatever is left is your wealth. This formula is so powerful, once applied can guarantee us to be build wealth. One must therefore take the time to learn and acquire the needed skills to build wealth: learn to increase cashflow, have the patience to wait, understand different money growing options that give better rates of return to beat inflation and know basic strategies to minimize (not evade) paying taxes.